Meet Your Next Hire

Ampliwork's AI agents are purpose-built for complex organizational challenges, combining enterprise-grade security, regulatory compliance, and adaptive intelligence. Each agent elevates how enterprises work - freeing teams to focus on strategic innovation while ensuring operational excellence at scale.

Talk to an expert todayMarketing, Sales, Product & Investor Relations

These agents are purpose built to empower sales and marketing teams by automating complex tasks that drive revenue and improve client engagement.

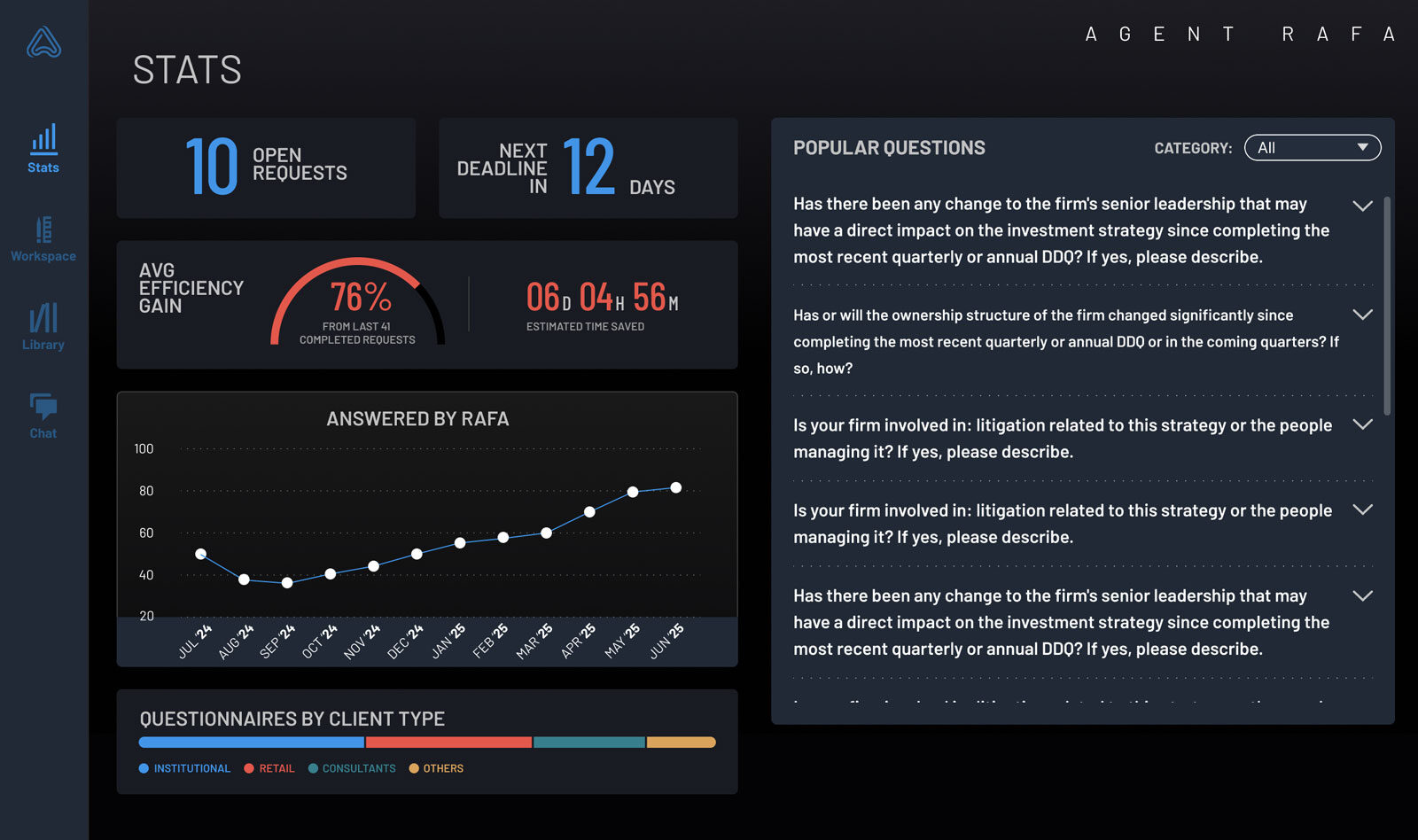

Agent RAFA

AI-native RFP & DDQ agent, precision-built for Investment Management Firms Asset Management | Investment Firms | Financial ServicesTurn 50+ hours of RFPDDQ work into 5 hours

RAFA is a state-of-the-art AI Agent purpose‑built to manage the intricate, time‑sensitive demands of RFP and DDQ responses in the tightly regulated Asset Management industry. Built on a compliance-first foundation, RAFA provides full, end-to-end auditability across the entire RFP cycle, from initial questionnaire receipt through to the creation of a polished, client-ready response consistent with your brand.

Benefits

- Reduce manual effort by up to 90% – Free your teams from tedious, repetitive tasks, enabling greater focus on strategic activities and client relationships without additional staffing.

- 80%+ RAFA generated answers get submitted as-is with no human intervention

- Financial services expertise – built specifically for financial markets, RAFA understands industry-specific nuances, delivering precision and accuracy tailored to your sector.

- No reliance on traditional OCR – Utilizes advanced AI-driven imaging models, eliminating the inaccuracies and limitations commonly associated with traditional OCR solutions.

- Audit readiness and transparency – Delivers full audit trails with detailed timestamps and source tracking, ensuring transparency, compliance, and audit readiness.

- End-to-end completion time of a full-scale RFP shrinks from several weeks to just 2 days

Skills

- Smart content retrieval – Seamlessly pulls the most relevant information from your curated library, factsheets, and performance-attribution reports.

- Product-aware intelligence – Detects the exact strategy or vehicle the RFP is asking about and surfaces the answers accordingly

- Format-flexible delivery – Effortlessly handles any questionnaire or response style, from PDFs and Word docs to Excel grids, free-text fields, multiple-choice check-boxes, tables, and web forms.

- Enterprise grade security & audit trail – Features SOC-2 and GDPR compliance, and granular, question level logs protected by fine grained, role-based access controls keeping every RFP response safe and verifiable.

- Effortless scale & streamlined workflows – Handles rising volumes of RFPs and DDQs in peak seasons optimizing processes so teams can take on more mandates without added strain.

- Self-improving intelligence – Real time user feedback and adaptive learning algorithms continually refine answers, boosting accuracy and operational efficiency over time.

“RAFA has transformed our RFP process, cutting our response time in half while ensuring 100% compliance with our internal risk policies.”

Director of RFP Management, Global Asset Firm

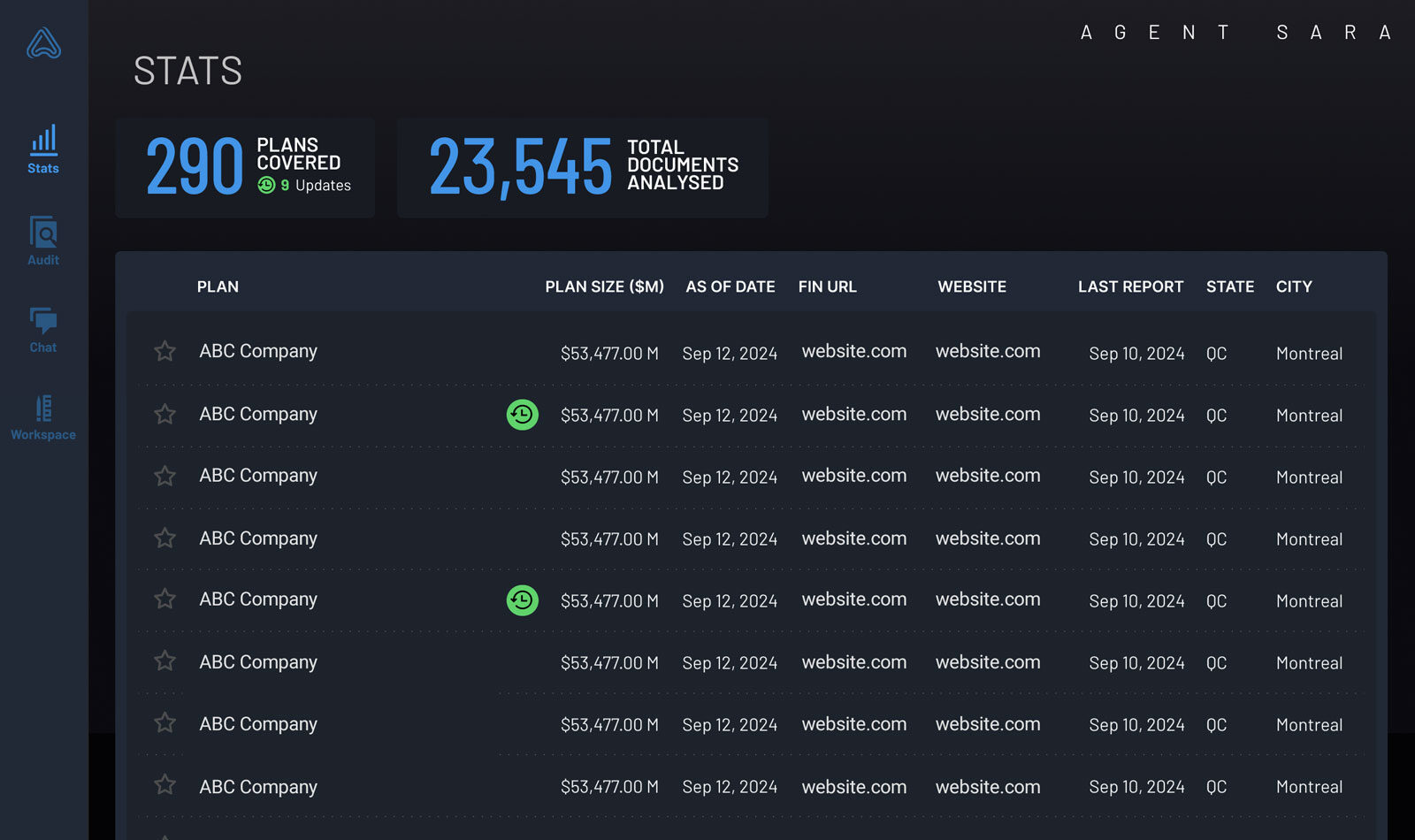

Agent SARA

AI-Powered Institutional Sales & Research Agent Lending Institutions | Mortgage Insurance | Financial ServicesAgent SARA is an AI-powered Institutional Sales & Research Assistant designed to enhance the capabilities of investment managers, sales teams, and investor relations professionals. With advanced language models and deep financial knowledge, SARA processes large volumes of investment data, provides strategic insights, and assists in research driven decision-making to improve client engagement.

Skills

- Compliance-First Approach – Ensures adherence to Fannie Mae, Freddie Mac, CFPB, and FHA lending regulations.

- Risk Mitigation – Identifies legal inconsistencies and prevents financial penalties and litigation risks.

- Enterprise-Grade Security – End-to-end encryption, SOC2 compliance, and role-based access controls for document security.

- ROI-Driven Impact – Reduces manual review time by 60%, leading to faster closings and increased loan volume.

- Document Processing – Accurately extracts, verifies, and organizes complex mortgage data across systems.

“Agent SARA has transformed our sales process, enabling us to curate investment insights in real-time, saving us hours in research.”

Head of Institutional Sales, $1T+ AUM Asset Manager

Agent FARA

FARA is an AI-native Fund Analysis & Research Agent, designed for Thematic Issuers. FARA replaces static, Excel-bound workflows with a real-time, multi-agent Discovery Engine that surfaces patterns in returns, flows, exposures, and peer dynamics to help product teams spot opportunities earlier. Lending Institutions | Mortgage Insurance | Financial ServicesBenefits

- Cut manual effort by up to 50% - Free analysts from repetitive data prep and spreadsheet pivots so they can focus on hypothesis testing and product design without extra headcount.

- 10× faster time-to-insight - Move from static month-old fact sheets to hourly updated intelligence, accelerating response to issuer launches, flows inflections, and leveraged resets.

- Enterprise-grade data integrity - Continuously validated ingestion and auto-mapping feed clean, structured metrics into the analyst stack, with infrastructure-agnostic integration.

- First-mover advantage - Detect niche exposures and under-served pair opportunities before rival filings by quantifying demand, overlap, and risk surfaces ahead of the market.

Skills

Key Capabilities

- Speed equates to Value in Finance – FARA converts Bloomberg extracts and custodial positions into a living ETF graph with hourly refresh, revealing hidden trends in leveraged-inverse, thematic, and bull-bear pair flows in seconds, not weeks.

- Domain-infused precision – Auto-maps ISINs, primary benchmarks, and leverage factors, then cross-validates with a vector-indexed metrics library (NAV, returns, volumes, flows) to ensure institution-grade accuracy across research outputs.

- Timely Competitive Intelligence – Instantly builds peer sets by issuer, theme, or factor tilt and computes performance vs. max drawdowns and correlation surfaces to quantify differentiation.

- Continuous improvement – Human-in-the-loop validations refine mappings, peer group logic, and factor tags on the fly improving signal quality with every query.

- Idea Engine – Agentic query orchestration enables unconstrained ad-hoc analysis, from launch windows and reset schedules to exposure gaps and basis risks, powering truly data-driven product ideation.

Operations & Middle Office

Designed to eliminate operational bottlenecks and reduce manual burdens; these agents focus on document heavy workflows to ensure efficiency and accuracy.

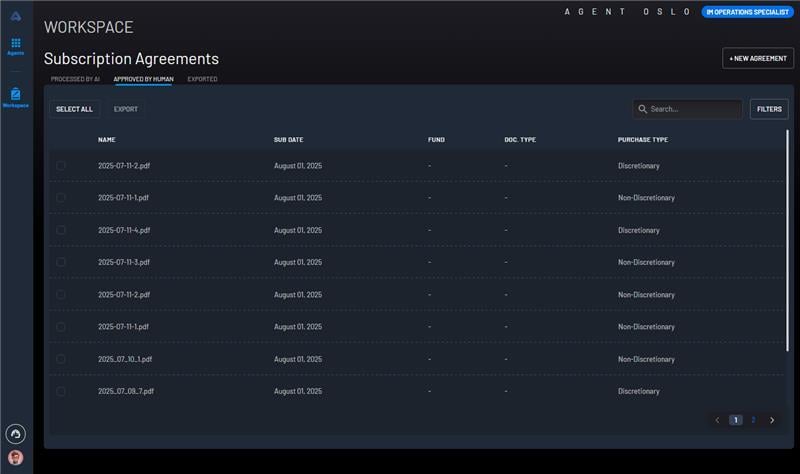

Agent OSLO

AI-native Subscription Agreement Processor, precision-built for Investment Management FirmsOSLO transforms cumbersome subscription-agreement workflows into a seamless, lightning-fast experience for investment managers. By cutting out the tedious back-and-forth between your Ops team and investors, OSLO slashes onboarding time and lets you start allocating capital sooner.

Benefits

- Cut manual effort by up to 80% - Free your operations team to tackle higher-value work and boost overall capacity; no extra headcount required.

- Sub-1-hour investor onboarding - Transform a process that once took days into an under-60-minute turnaround, giving clients a faster and more transparent experience.

- Enterprise-grade data integrity - Consistently validated extraction feeds clean, structured data into any system, thanks to seamless, infrastructure-agnostic integration.

- Full auditability & explainability - Every extraction, edit, and email is time-stamped and source-tracked, delivering detailed audit trails and regulatory readiness.

- 97% of all fields correctly captured in first pass

90% reduction in average bill processing time

Skills

- Best-in-class performance – OSLO eclipses legacy OCR and generic LLM tools with 99%+ field coverage and 96%+ first-pass accuracy, shrinking document review from hours to seconds.

- Domain-infused precision – Every data point is double-checked by a sub-agent that leverages deep fund-administration expertise, ensuring audit-ready results.

- Seamless multilingual onboarding – Effortlessly processes subscription agreements in multiple languages and jurisdictions, accelerating investor onboarding worldwide.

- Continuous improvement – Human-in-the-loop feedback loops refine OSLO on the fly, pushing accuracy higher with every interaction.

- Email Intelligence – ML-powered classification pinpoints critical email attachments and automates investor follow-ups, thus slashing email/SharePoint back-and-forth by 10× for a faster, frictionless experience.

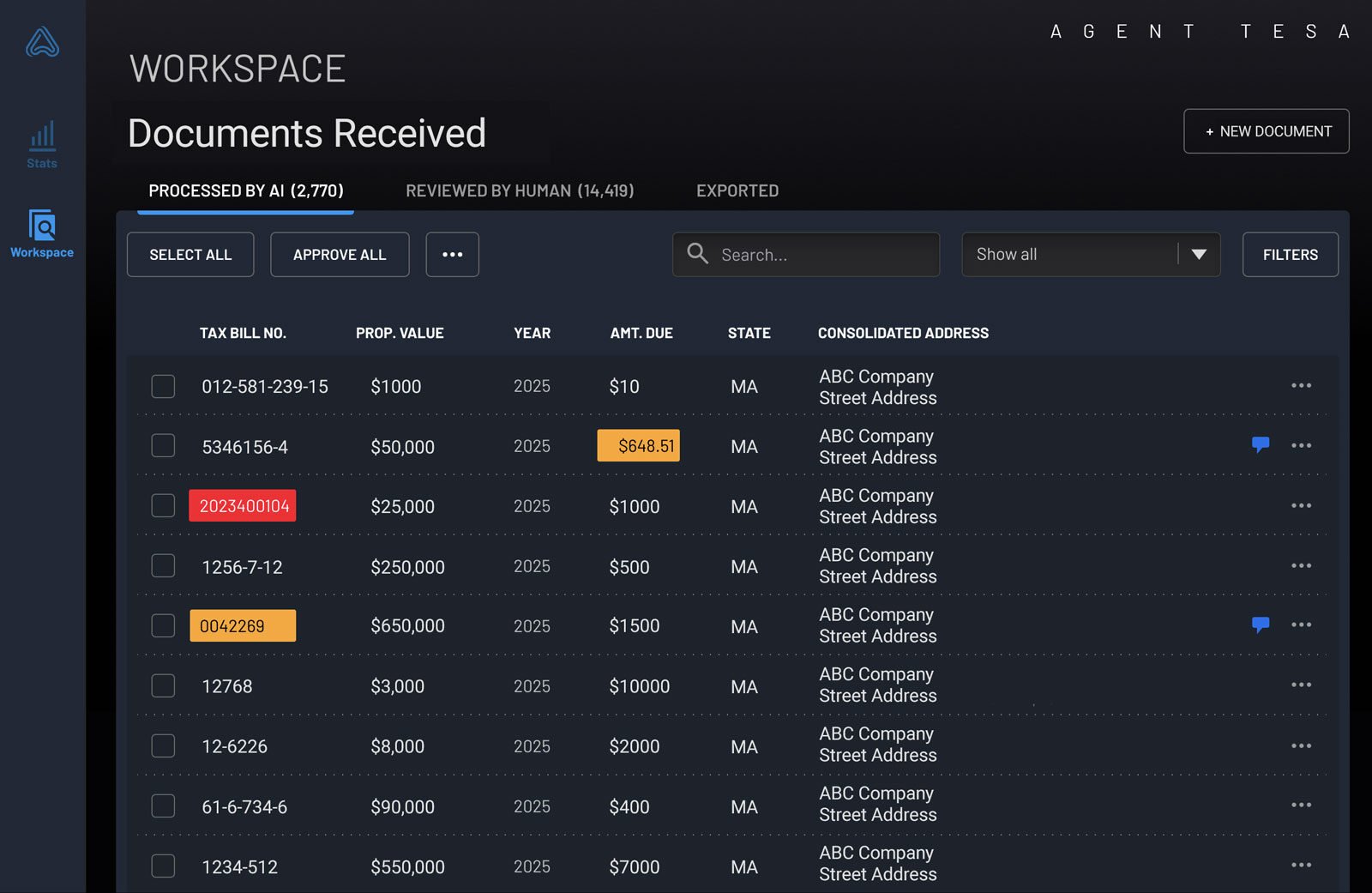

Agent TESA

AI-powered Property-Tax Bill Processor purpose-built for accounting firms Consulting Firms| Compliance Automation | Financial ServicesTESA reads, validates, and routes multi-jurisdiction tax bills with a 93% field-level accuracy, turning what used to be a week-long paper chase into a single-afternoon push. TESA can process 1,000 utility bills in under five hours, zero additional head-count required.

Benefits

- Cut manual effort by 90 % – Partners see staff-hours drop from days to hours per cycle, freeing teams for advisory work.

- Never miss a deadline – Smart risk alerts surface variances days before due dates, keeping payments on schedule and penalties at zero.

- Scale without head-count – TESA processes thousands of bills per week on existing head count, eliminating the need for temp staff or overtime.

- Start ROI in four weeks – Deployment goes live inside a month.

- 93%+ accuracy across all essential fields for all the 3000+ counties in US

- End-to-end automation from bill collection to updating Property Tax system with relevant data reduces manual processing time by 80%

Skills

- Best‑in‑class performance – TESA delivers 93 % first‑pass field accuracy eclipsing legacy OCR and generic LLM tools and cutting document review from hours to minutes.

- Jurisdiction-agnostic extraction – Handles 3,500+ counties and cities, messy scans, and multi-page PDFs; captures payee, amounts, due dates, owner, and 20+ supporting fields.

- Risk-based auto-validation – Compares each field against prior-year logic and rules; flags variances before they become late-payment penalties.

- Seamless tax-system integration – One-click exports feed clean, structured data directly into your existing tax system.

- Batch throughput at scale – Process 1,000 bills in < 5 hours; no tuning needed when volumes spike.

- Continuous improvement – Human-in-the-loop feedback refines TESA on the fly, raising accuracy with every tax bill processed.

- Audit readiness & full transparency – Every extraction and subsequent edit is time‑stamped and source‑tracked, creating an end‑to‑end audit trail.

“TESA transformed our back-office operations—cutting manual processing time, eliminating errors, and accelerating compliance.”

Director of Operations, Consulting Firm

Agent CLARA

CLARA is a multi-capability AI agent suite designed for institutional family offices, built to transform complex, multi-step operations into an integrated, high-speed workflow. From investor onboarding to compliance tracking, CLARA replaces manual, fragmented processes with precise execution to reduce operational load and unlock more time for strategic client work.Benefits

- 80% reduction in manual effort – Automate repetitive workflows across subscription processing, reporting, compliance, and communications, freeing skilled staff for high-value work.

- 5× faster subscription completion – Slash onboarding time with fewer errors, and generate reports in minutes instead of hours, saving 8+ hours per reporting cycle.

- 0 missed deadlines – Compliance monitoring flags regulatory changes and filings well in advance, preventing penalties and operational risk.

- 1000s of tasks processed without added staff – Scale operations to handle peak workloads without increasing headcount.

- Higher client retention & engagement – AI-powered insights surface timely outreach opportunities and draft personalized messages to strengthen relationships and uncover growth opportunities.

- < 4 weeks to ROI – Go live in under a month with measurable productivity gains from day one.

Skills

Key Capabilities

- Subscription Document Processing – Completes investor subscriptions 5× faster by gathering client data from CRM and portfolio tools, auto-filling template fields, flagging gaps for review, and finalizing with e-signature.

- Intelligent Document & Email Triage – Continuously monitors inboxes and platforms, identifies priority documents, and routes them to the right agent, attaching related communications for full context.

- Real-time Reporting – Integrates with client reporting platforms to classify transactions, generate commentary, and maintain tagging standards, cutting hours from each reporting cycle.

- Regulatory & Compliance Monitoring – Tracks updates from the SEC, IRS, and state tax boards, linking changes to affected clients and issuing proactive alerts to avoid missed filings.

- AI-Powered Client Engagement – Analyzes CRM, portfolio, and external news signals to surface timely, personalized outreach opportunities.

- Centralized Data Hub – Consolidates and validates information across systems, creating a single source of truth for reporting and insights.

- Security & Compliance by Design – SOC 2 Type II and ISO 27001-aligned controls to ensure data protection and regulatory readiness.

Compliance & Risk

These agents are engineered with financial services regulations in mind to ensure audit-readiness and minimize risk across critical workflows.

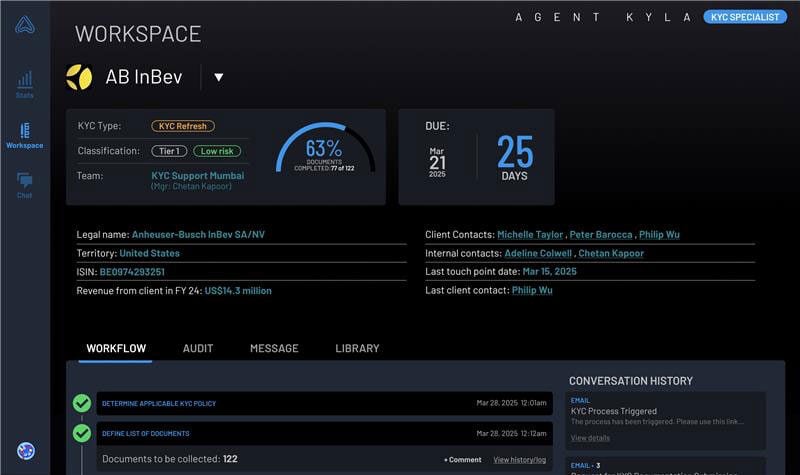

Agent KYLA

AI Agent purpose-built to streamline and automate KYC (Know Your Customer) processes in Financial Services, powered by state-of-the-art AI and domain-specific compliance frameworks.Core Value Proposition

- Accelerate Customer Onboarding: Reduce KYC processing times dramatically—from weeks to just days or hours.

- Enhance Compliance & Accuracy: Ensure consistent adherence to regulatory standards with AI-driven precision.

- Mitigate Risk & Operational Burden: Handle high volumes of KYC checks without compromising quality or compliance.

- Future-Proof Regulatory Framework: Stay ahead of evolving regulations with adaptable AI models and industry-specific compliance templates.

Tangible Outcomes

- Faster Client Onboarding: Cut onboarding times by up to 80%, enabling quicker revenue realization.

- Improved Compliance Assurance: Ensure 100% regulatory compliance and significantly reduce compliance risks.

- Operational Efficiency: Decrease manual workload on compliance teams, allowing experts to focus on high-value tasks.

- Cost-Effective Performance: Leverage a pay-for-performance pricing model that guarantees cost savings against current labor costs.

Skills

Key Features & Differentiators- Technical Differentiation: Utilizes proprietary IP and technology-agnostic models optimized with both proprietary and open-source LLMs, delivering unparalleled accuracy and integration capabilities.

- Domain-Specific AI: Tailored specifically for financial services, ensuring comprehensive coverage of complex KYC and AML requirements.

- Centralized Compliance Hub: Consolidates all customer data and compliance requirements into a single, unified platform for streamlined management and regulatory reporting.

- Human-in-the-Loop Oversight: Combines automated processes with human expert validation to refine KYC checks, minimizing false positives and enhancing efficiency.

- Audit Trails & Transparency: Provides detailed, timestamped audit logs for every verification step, enabling full traceability and regulatory transparency.

- Rapid Integration & Scalability: Quickly deployable within 12 weeks with seamless integration into existing enterprise systems, scalable to manage increasing client volumes and regulatory complexity.

“Agent KYLA drastically reduced our KYC backlog, turning weeks of work into just a few days. Compliance has never been smoother.”

Head of Compliance, Leading Investment Bank

Agent CORA

Ampliwork’s Agent CORA transforms fragmented, manual control environments into intelligent, standardized, and continuously improving frameworks. It integrates seamlessly with existing systems to cut cost and complexity, strengthen governance, and deliver audit-ready confidence — all while evolving with the business.Core Value Proposition

Agent CORA tackles many of the industry problems related to Controls — fragmented control estates, duplicated testing, and inconsistent evidence — without disrupting existing systems.

- Data Ingestion & Integration – Unifies fragmented control data into a single, reliable source of truth.

- AI Intelligence Layer – Standardizes and deduplicates controls, benchmarks effectiveness, and continuously learns from outcomes.

- Insights & Governance – Delivers real-time dashboards, audit-ready evidence, and role-based oversight.

- Flexible & Secure Deployment – Cloud-agnostic, enterprise-grade, and compliant with SOC2, ISO, and GDPR standards; scalable across units and geographies.

Tangible Outcomes

- Material reduction in manual effort and time-to-assurance

- Reduced cost and complexity through streamlined ownership, testing, and monitoring

- Better coverage and consistency; stronger regulatory confidence

- Greater resilience via standardized libraries and smarter control mapping

- Regulatory confidence enabled by evidence-backed, audit-ready governance

- Continuous improvement powered by AI-driven recommendations that evolve with the business

- Rapid validation via a 4–6-week POC; typical go-live in 6–8 weeks, payback <12 months

Skills

-

Standardizes and Simplifies Controls – Transforms fragmented libraries into a consistent, high-quality framework that reduces duplication and complexity.

-

Delivers Audit-Ready Governance – Generates traceable evidence, enforces role-based approvals, and ensures compliance confidence.

-

Provides Real-Time Insights – Benchmarks effectiveness, scores risk exposure, and delivers executive dashboards for faster decision-making.

-

Continuously Improves Over Time – Learns from outcomes and adapts controls to evolving regulatory and business demands.

Custom Solutions

For organizations with specialized or highly complex challenges that require a unique approach, Ampliwork also offers a custom agent solution.